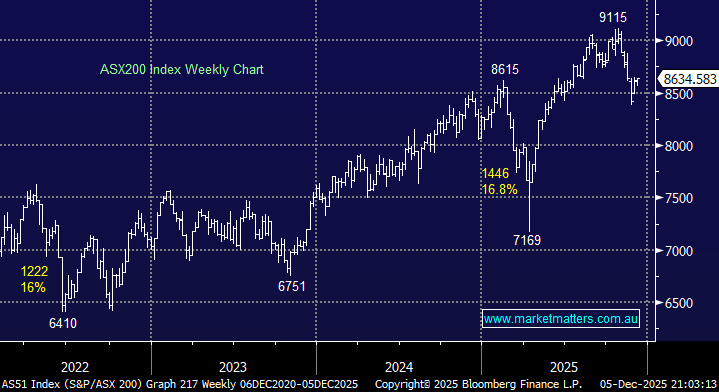

Always expect the unexpected is a very useful adage for investors, and today, we have looked at 3 cases that would put a spanner in the works for the majority of investors as they sit in the contrarian corner with 2024 looming on the horizon – it’s now only 20-days until Christmas.

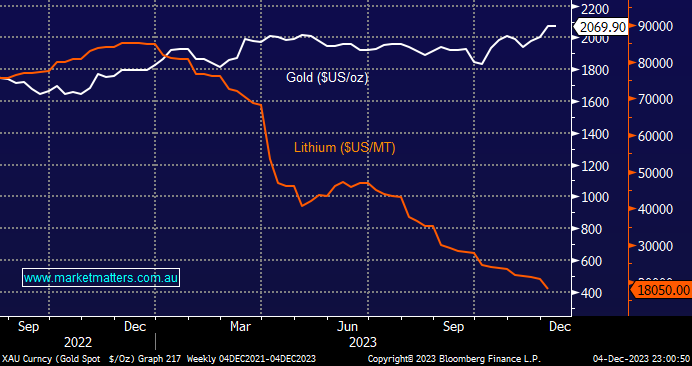

It’s worth remember this time last year; everybody was bullish on the EV trade while gold was hardly getting a mention. Here we are with a few weeks left of 2023, and lithium has crashed ~80% while gold posted fresh all-time highs. Below we kick around some alternative views after reading the latest Bank of America Fund Managers Survey as we consider, what if the crowd is wrong again:

- The “Magnificent Seven” will have a tough year after the FANG+ Index made fresh all-time highs in November.

- The embattled Chinese market finally enjoys a recovery as Beijing turns the world’s second-largest economy around.

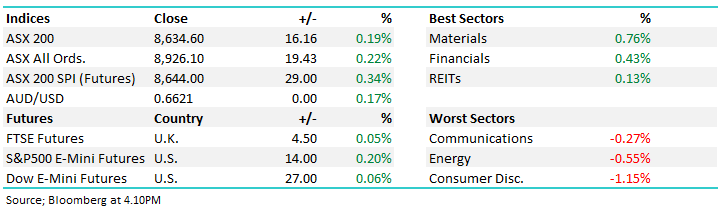

- The RBA is wrong, and our economy is weaker than thought, and they will cut cuts as fast as the Fed.

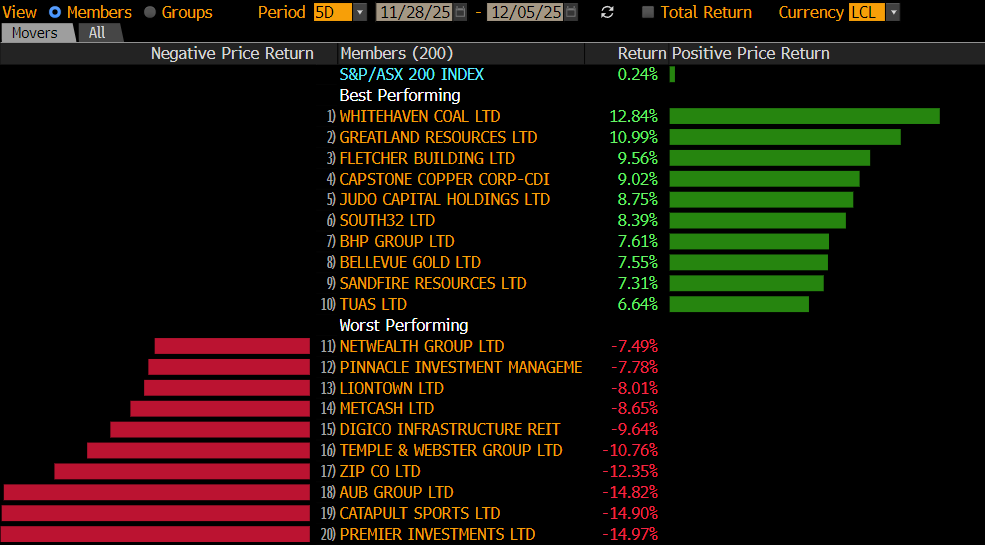

- The current bounce by small caps becomes a new trend as opposed to a period short-term period of reversion.

- The most aggressive period of interest rate hikes in history creates a recession as opposed to the “Goldilocks scenario” expected by investors at the moment.

This morning, we’ve briefly looked at three scenarios that should be at least considered as a possibility as we approach 2024: