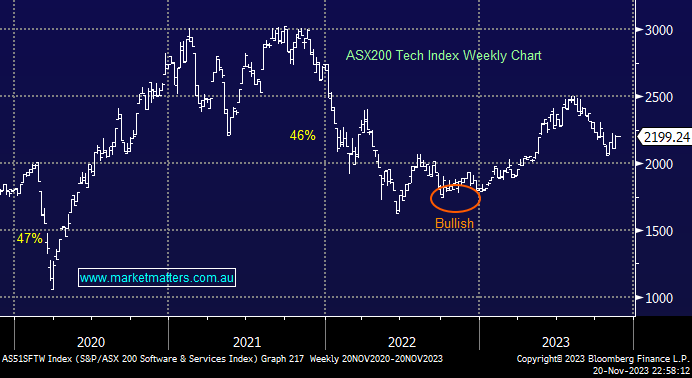

A year ago, we went overweight the Tech Sector, which, after a few false dawns, eventually proved an excellent value add for portfolios. However, unfortunately, the local market failed to keep pace with the “Magnificent Seven”, i.e. the FANG+ Index hit fresh all-time highs overnight. In contrast, the local tech sector languishes over 35% below its 2021 high. We have now adopted a neutral stance towards US Tech. However, further upside is likely over the coming weeks; we are currently focused on levels to reduce exposure as opposed to increasing.

- MM has now donned its “seller hat” with regard to tech stocks from a risk/reward perspective.

Today, we are long Altium (ALU) and Xero (XRO) in our Active Growth Portfolio for a collective 10% exposure, a significantly overweight position compared to the Tech Sector, which makes up less than 5% of the ASX200; hence, we are likely to switch at least one of these positions over the coming weeks.