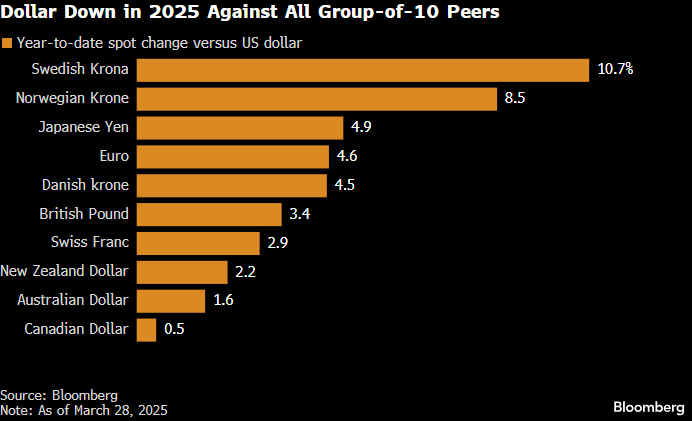

The dollar, for many years, has been a hiding place during market selloffs, but it hasn’t rallied this time as investors rushed for safety. The Trump effect has seen the $US no longer act like a haven, and just two months into his second term, his escalating tariffs and bid to roll back decades of globalisation are shaking confidence in the US currency — which has had a privileged place at the heart of the world financial system for many decades. The dollar has dropped against all but a handful of the 31 major currencies over the last three months, sending the US dollar index down nearly 3%, its worst start to a year since 2017.

- Trump’s actions are rekindling long-simmering discussions about whether overseas governments will accelerate efforts to lessen reliance on the Greenback.

Trump’s trade policies, a pullback from military alliances, and casual talk of taking over Canada or Greenland could accelerate the migration away from the US dollar, and undermine its value. In theory, tariff increases should strengthen the currency by reducing demand for imports and bolstering domestic factory output. However, it has depreciated instead, as the scale of Trump’s hikes risks both reigniting inflation and slowing growth.

- The dollar has not lost its safe-haven status, but we must seriously contemplate the possibility in the years ahead.

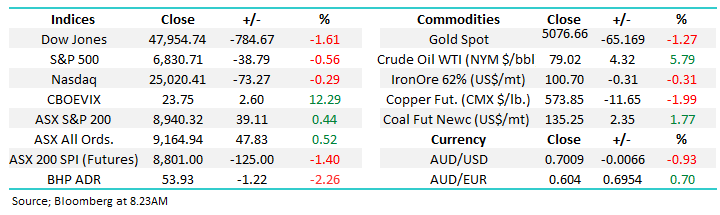

Last week, the dollar traded weaker against the Yen and Euro amid US economic data showing weaker-than-expected consumer spending and rising inflation. However, short-term US Dollar sentiment has hit a multi-year low, positioning it perfectly for a bounce; however, we would not look to buy this dip in the US dollar. Our caution regarding the $US is the central question hanging over our view that this week will see market reversion, although, in today’s rapidly unfolding market, the move could be over in a few months.