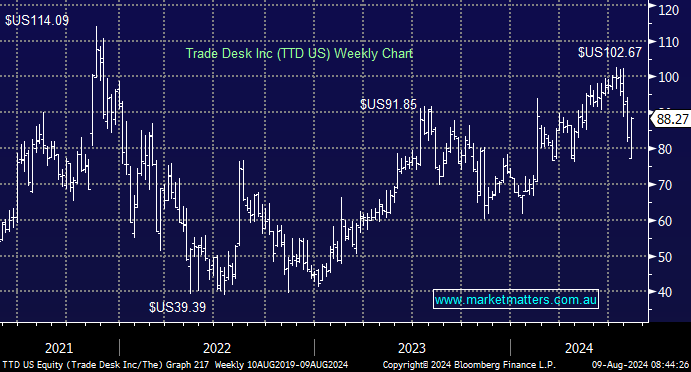

The advertising Technology company reported 2Q results after the close that were strong, above expectation for the period, and Q3 guidance beat consensus. Shares are trading 10% higher in after-hours trade:

- Revenue $585 million, +26% y/y vs estimate $578.4 million / 1.2% beat

- Adjusted EPS 39c, up from 28c y/y, vs estimate of 35c / 11% beat

- Adjusted Ebitda $242 million, +34% y/y, estimate $225.8 million / 7.2% beat

These numbers highlight that TTD’s accelerating growth is coming with better profitability—a great sign. With sentiment recently quiet negative towards digital advertising, this result is very encouraging. For Q3, they guided revenue of at least $618 million, 2.3% ahead of current consensus, and Ebitda around 1.2% ahead of consensus, noting they generally beat guidance, which the market has already factored into assumptions.