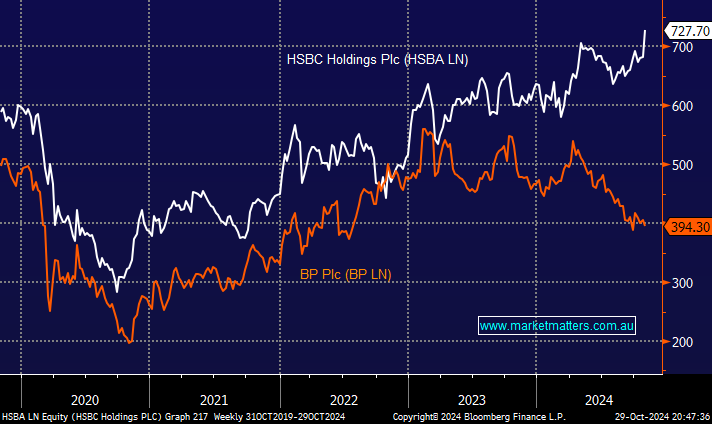

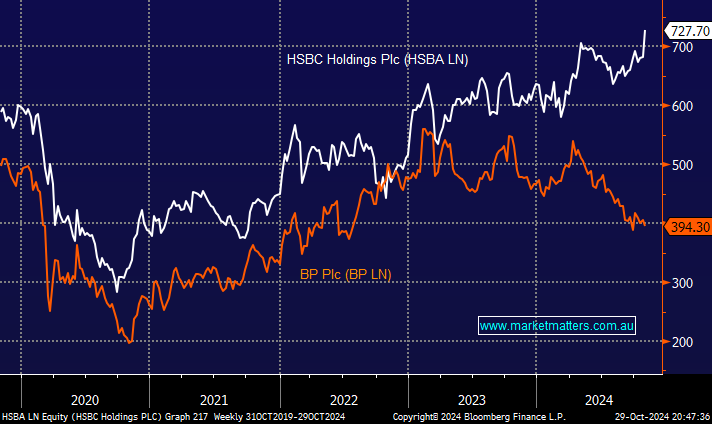

A slightly different piece this morning as early moves on European markets highlighted a dominant characteristic of 2024:

BP Plc (BP LN) GBP379.25

The British major kicked off earnings season for the world’s giant oil companies with an adjusted profit of $2.27 billion in the third quarter, ahead of the average analyst estimate. BP maintained the pace of its quarterly buybacks at $1.75 billion even as weak oil prices put pressure on the company’s balance sheet. The British oil major increased its net debt by $1.7 billion to $24.27 billion, the highest since the start of 2022. In addition to the effect of falling crude prices, BP’s profits were also crimped by weaker margins for refined fuels. Increasing debt to fuel buybacks is an interesting approach, not one we would take.

- Similar to Woodside (WDS) and Santos (STO), we see new 2024 lows in the short term.

HSBC Holdings Plc (HSBA LN) GBP713.70

Overnight HSBC Holdings Plc announced a fresh multibillion-dollar stock buyback as it reported better-than-estimated earnings, days after unveiling a significant overhaul of its businesses. Europe’s largest bank intends to repurchase up to $3 billion of shares on the back of a 9.9% gain in pretax profit from a year earlier to $8.48 billion, well above consensus at $7.6 billion. The results were driven by gains in its wealth arm, which benefited from higher private banking volumes in Asia, a solid result following in the footsteps of its US peers.

- We see no reason to fade the current strength in HSBC, although buying here is tough from a risk/reward perspective.