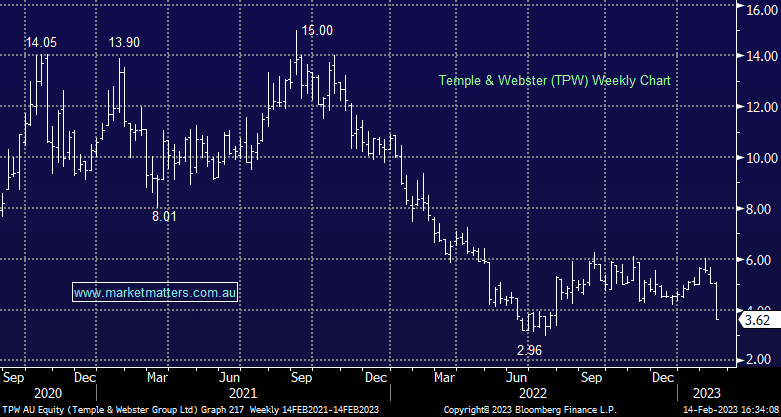

TPW -26.87%: the e-commerce furniture retailer struggled today following some sour comments at the half-year result. The numbers themselves were largely as expected with revenue of $207m just 2% below consensus while EBTIDA of $8.5m was a ~20% beat. Margins improved into the end of the year as the company benefitted from high supplier inventory and lighter-than-usual promotional offers. Supply chain costs were up, but less than expected and marketing expense margins fell substantially as the company cut costs. The concern came with forecast numbers where the company dropped the “double-digit growth” target over the medium term. Sales for the first 5-weeks of 2023 were down 7%, blamed on elevated comps as a result of the Omicron outbreak in January 2022. Their venture into an online Bunnings competitor is also chewing through cash faster than expected without the results coming through. Overall it seems e-commerce is struggling to keep up with the competition of bricks and mortar operations with an online presence.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral TPW

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.