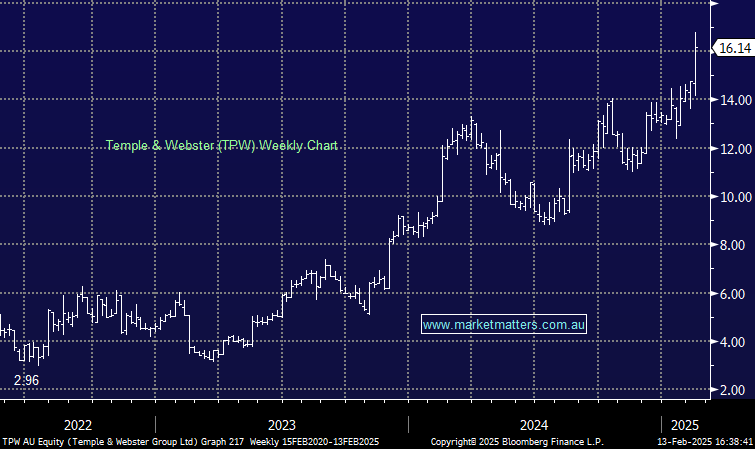

TPW +13.03% delivered a better-than-expected half-yearly, driven by stronger earnings as a result of strength in home improvement sales on top of their now 2.9% share of the Australian retail furniture and homeware market.

- 1H25 revenue $313.7m vs. $310.2m consensus (+24% YoY)

- 1H25 Ebitda of $15.6m vs. $8.8m consensus

- FY25 Ebitda margin guidance maintained at 1-3%.

- Home improvement segment grew 41% yoy

Originally a simple online furniture and homewares retailer, the business has expanded into high-growth categories such as home improvement and bathroom fittings. Of note, they are exploring third-party installation services, particularly for flooring and tiling, to create a full-service, one-stop home improvement platform.

TPW’s own exclusive brand now represents 45% of total revenue, giving the business more control over their brand and costs without taking on inventory risk. Notably, U.S trade tariffs could help the business negotiate better pricing from its suppliers in China which will improve margins further.

- The result demonstrates an ability to improve margins whilst maintaining the revenue line… usually one or the other suffers… which speaks to the success of the overall strategy to diversify their revenue streams.