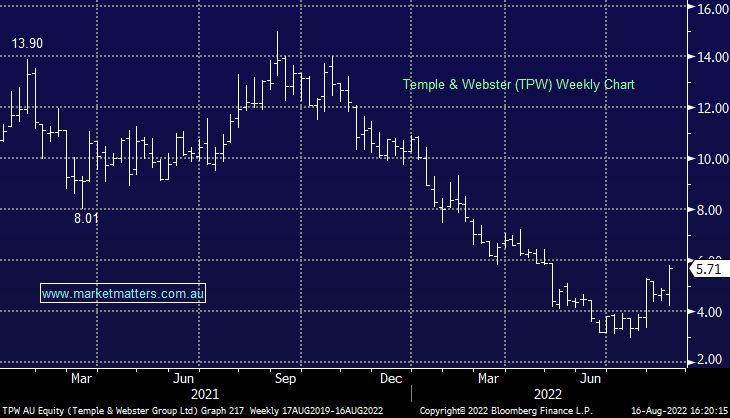

TPW +29.77%: FY22 results this morning showed mixed numbers for FY22 and FY23. Revenue grew more than 30% to $426m which was slightly behind expectations. EBTIDA was better though with margins coming in at 3.8% for the year, at the high end of guidance. This also included a $1.7m spend on The Home, Temple & Webster’s new home improvement site which has started positively. FY23 has started slowly, though they are cycling on lockdown boosted sales from last year. FY23 sales were down 17% for the period to August 14th, though management said this was as expected and growth to return to double-digit levels “once we finish lapping COVID lockdowns.” EBITDA margin guidance for the year was also upgraded to 3-5%, and that is the key to the result.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish TPW

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.