TLX has been a hot biopharmaceutical stock focused on radiopharmaceuticals, which combine diagnostics and therapeutics (i.e. theranostics) using molecularly targeted radiation (MTR) – a bit of a mouthful. They also have a manufacturing arm (Telix Manufacturing Solutions) to produce radiopharmaceuticals at scale.

Illuccix is Telix’s flagship product, which has been the main driver of the company’s success in recent years while Gozellix, a recently FDA approved radiopharmaceutical diagnostic agent used to detect prostate cancer is their next big driver.

However, TLX has struggled sin the past few months after announcing that it had received a Securities Exchange Commission (SEC) subpoena request related to the development of the company’s new prostate cancer therapies, and whether Telix may have overstated or misrepresented the readiness of prostate cancer therapies (for example, labeling something “Phase 3 ready” prematurely) in its public communications or investor disclosures.

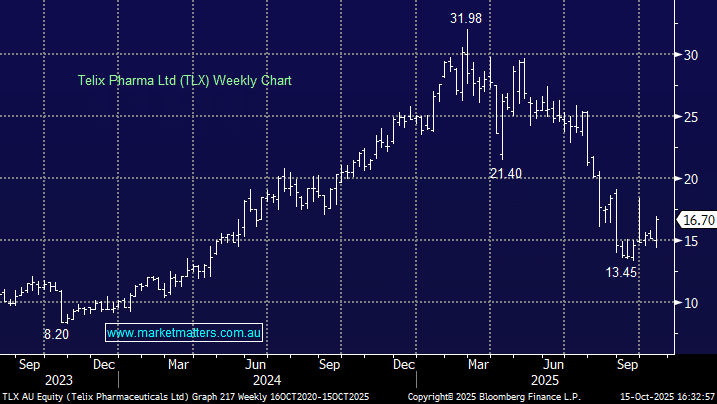

When the news broke, TLX got on the front foot, confirming FY25 revenue guidance remained unchanged at ~$770-800 million, but we remain in a market that’s preferring ‘certainty’, and an SEC probe is anything but certain. The stock has fallen ~40% since, before a sharp rebound yesterday, with shares up over +16%, due to an increase in revenue guidance to $800-820mn for the FY, underpinned by strong momentum in Illuccix and early Gozellix uptake.

Telix is entering Q4 in good shape, having reported 3rd quarter revenue of $206mn, up +53% YoY. The company is supported by a growing customer base, two FDA-approved PSMA imaging agents, and CMS reimbursement for Gozellix, effective from 1 Oct. in the U.S. The fundamentals of this business remain sound with two great products and effective market rollout. However, until there’s more clarity around the SEC inquiry, uncertainty will likely linger, but are the risks already in the price?

Even after yesterday’s strong move, TLX is trading more than 30% below its pre-SEC level, building plenty of bad news into the outcome. Because the U.S. SEC subpoena is still an active investigation, it’s impossible to say with certainty exactly how it will be resolved, but one of 3 scenarios is likely, depending on the interpretation of whether Telix’s disclosures were over-optimistic or poorly worded as opposed to being deliberately misleading: firstly, no Charges, regulatory dividends only, secondly, civil penalties and corporate governance actions and thirdly more severe consequences (less likely).

- We like TLX as a business, and while the risks are obvious, we like the risk/reward at current levels.