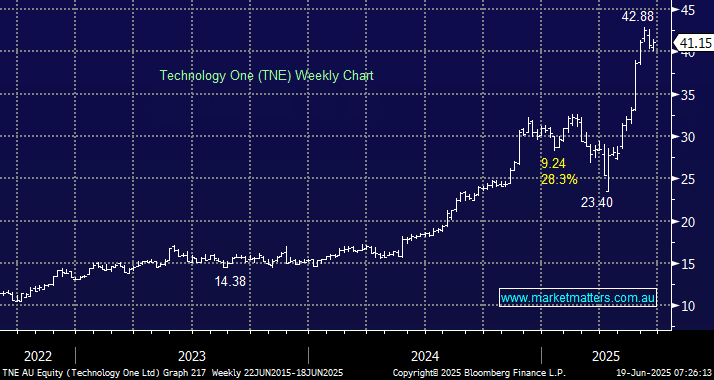

TNE has advanced over 31% in 2025 and it’s still trading within striking distance of this months all time high. Last month’s 1H25 earnings report was very strong with management upgrading profit guidance for FY25 – a very common trends from TNE in recent years. Importantly, after initially appearing overly optimistic, the business appears to be on course to achieve its target of $1 billion in recurring revenue by FY30. Such metrics would make today’s almost 100x valuation far more palatable. For the first half, a 19% increase in revenue to $291 million generated a 31% increase in earnings (Npat) to $63 million. However, this is a company with a market capitalisation of more than $13 billion, and plenty of good news is now built into the share price.

The share price is consolidating nicely above $40, and after last month’s sugar hit, we don’t expect sentiment to turn on Australia’s biggest business software company, which sells an all-in-one cloud system that helps organisations manage things like finances, staff, projects, and assets, in one place. We believe TNE is a stock that can be “bought into dips” through the remainder of 2025, but we would not be chasing the current strength

- We can see trading between $35 and $45 in the 2H of 2025.