We’ve discussed TNE a few times of late Here with the stock on our Active Growth Portfolios Hitlist.

Technology One (TNE) is a high-quality Australian software business providing mission-critical enterprise software, mainly ERP, finance, HR and student management systems to government, education and large institutions, with a sticky, long-duration customer base and increasingly recurring SaaS revenue.

- The AI opportunity is meaningful: embedded automation can improve workflow efficiency, reporting, customer service and decision-making, while also reducing implementation and support costs, effectively strengthening a product and lifting customer value.

- However, AI is also a risk factor, as it lowers barriers to entry and could accelerate competition from global ERP players and AI-native challengers, while customers may push back on pricing if AI features become “table stakes”.

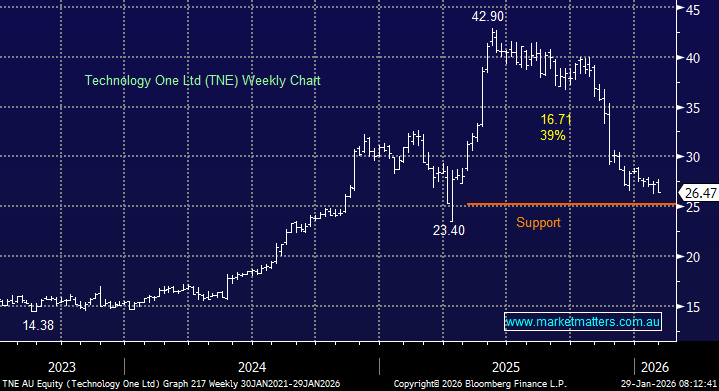

The key for TNE is execution: if it successfully integrates AI into its platform and uses it to deepen customer lock-in, AI becomes a tailwind; if not, it risks gradual commoditisation of parts of its offering and a slower growth runway. These risks, plus a disappointing trading update in November, which showed after reporting annual recurring revenue (ARR) below expectations, have seen the stock correct by close to 40%.

TNE operates in competitive markets where global scale players remain a constant threat, with SAP, Oracle, Microsoft (Dynamics) and Workday all capable of targeting large enterprise and government customers with deep product suites and heavy R&D budgets. While TNE has carved out a strong niche in ANZ — particularly across local government, education and public-sector verticals — the key risks are that competition intensifies as cloud migration accelerates, customers consolidate vendors, or global platforms become more aggressive on price and bundling. AI adds another layer of disruption: it can lower switching costs over time by making integration and data migration easier, and it enables rivals to rapidly replicate workflow features that once differentiated incumbents.

TNE’s main defence is its entrenched customer base, long contracts, high switching costs and strong local domain expertise, but the market will remain highly competitive, and any execution slip (implementation issues, slower product innovation, or margin pressure from rising costs) could quickly impact confidence in what is still a premium-rated software name.

This $8.7bn company has seen its shares tumble in line with the software sector, although like XRO and WTC its still not cheap trading on a 54x Est FY26 earnings. However, with revenue forecast to grow from below $600mn in FY25 to almost $800mn by FY27, there is some obvious foundation for this high PE.

- We like TNE at current levels, but with the average customer spending $100,000++ pa annum, AI may impact them in the medium term.