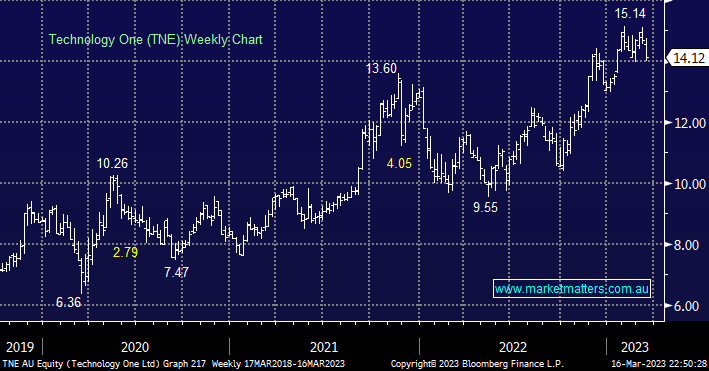

This HR & asset management SaaS company is an active growth story that continues to deliver with over 90% of its revenue reoccurring, the only issue is around extrapolating growth moving forward but its targeted Annual Reoccurring Revenue (ARR) in excess of $500mn by FY26 looks achievable making its current 46x valuation high, but not unjustified.

- We like TNE but the risk/reward isn’t exciting unless we see a repeat of its $3 correction witnessed in H2 of last year.