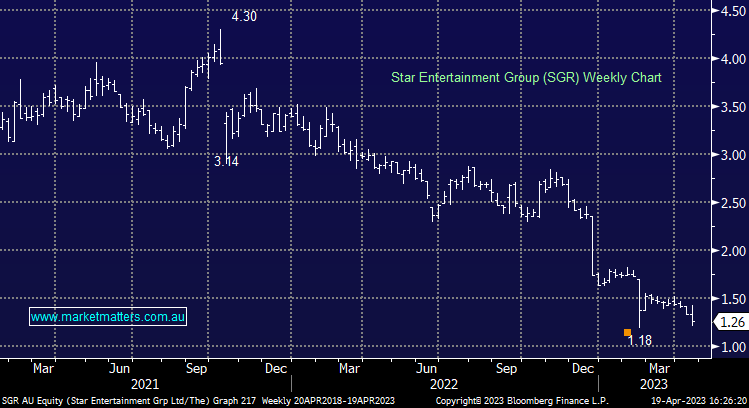

SGR -7.35%: the casino group struggled today, nearly trading below the price of the February equity raise after downgrading guidance. The group now expects EBITDA for FY23 between $280-310m, around 15% below prior guidance and consensus expectations, blaming regulatory restrictions and a deteriorating consumer environment. In an effort to recoup some of the lost earnings, Star is looking to add to their cost-cutting measures by letting go of 500 full-time equivalent jobs, freezing any non-EBA pay increases and cancelling any short-term incentives aiming to cut an annualized $60m in costs in addition to the $40m that was previously announced. In addition to the above, they have appointed bankers to conduct a strategic review of their assets, signalling a potential sale of their cornerstone Sydney Casino, right when Crown has started competing from the other side of Darling Harbour.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral SGR

Add To Hit List

Related Q&A

Star (SGR) turnaround

NTA of Star Entertainment (SGR)

What’s MM’s thoughts on Star Entertainment (SGR) over the years ahead?

Thoughts on SGR & SWF, please

Are MFG & SGR still two titillating turnarounds?

Is the Star (SGR) getting interesting?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.