SBM -10.94%: the mid-cap gold company struggled today after writing down 2 assets at their half-year result. They announced an underlying loss of $8.66m, however, they also added a $420m impairment at Atlantic, and a $74m at Simberi, two assets they are looking to demerge from the group. Production issues plagued the company in the half, forcing guidance to be amended to the low end of prior production expectations, and the high end on costs. Talks are ongoing with peer Genesis (GMD) to merge their Leonora assets, a deal that still has a number of hurdles to complete and today’s result put pressure on a few caveats.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

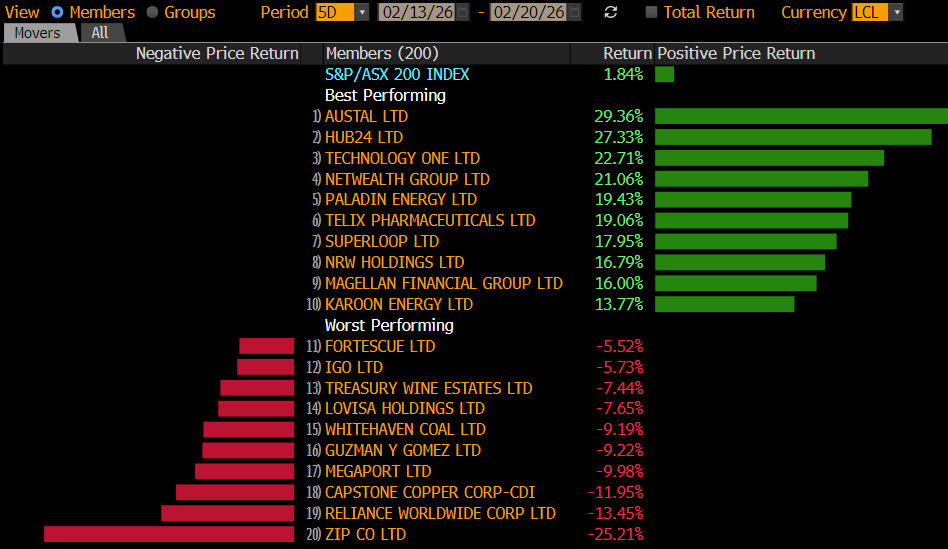

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral SBM, considering cutting from the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Thoughts on St Barbara (SBM) & Genesis (GMD) please

Thoughts on the 2nd tier gold shares please

Thoughts on SBM please

Is it time to exit SBM?

Where does MM see St Barbara (SBM) topping out?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.