Spotify is one of those rare global platforms that’s become a daily habit for hundreds of millions of people. It’s now the clear leader in audio streaming, with over 700 million monthly active users and around 280 million paying subscribers across 180 markets – phenomenal scale. For years, the story was all about growth at any cost – build scale, own the customer relationship, and keep expanding. That phase is largely done. The next chapter is about turning that scale into sustainable profitability, and we think the market is still under-appreciating how powerful that shift could be.

Recent results show that Spotify is finally starting to monetise its enormous audience. Gross margins are improving, net profit margins have pushed past 8%, and the company has turned free-cash-flow positive. Subscription revenue remains the core engine, but we’re also watching the advertising segment closely. Ad-supported revenue is still only ~11% of the total, well below Spotify’s long-term ambition of 20%, but the direction of travel is positive. As the platform continues to refine its ad-tech and leverage first-party data, that segment should become a meaningful profit driver.

Looking at SPOT from a traditional valuation perspective is tricky, given that it has spent aggressively on becoming the dominant platform, and is only now working hard to commercialise its scale and breadth in the marketplace. What’s also interesting at this point in the cycle is the combination of global runway and operating leverage. Spotify’s penetration in emerging markets remains low, while in developed regions, pricing power is improving.

The company has begun lifting subscription prices in its more mature markets. In September, Spotify announced price increases across 150 markets, including a 14% price increase for its Premium Individual plan in Australia (to A16.99/month), as the app provides more value to customers via bundled music and audiobook offerings. The company continued to roll out hikes in select European markets like the UK and Switzerland following earlier Sept adjustments in regions across South Asia, MENA, and Latin America. We expect a potential price increase in the US for the individual plan, likely from $US11.99 to 12.99, along with the rollout of a Premium offering, which could be priced above $US20. These adjustments are part of an ongoing pricing cycle tied to rising content licensing costs.

* Importantly, there is little evidence of churn, and SPOT continues to diversify its offering into podcasts, audiobooks, and creator tools. These initiatives aim to deepen engagement, improve monetisation per user, and reduce dependency on the major music labels that still take a big cut of revenue.

Of course, it’s not without risk. Spotify operates in a very competitive space where Apple, Amazon, and YouTube can subsidise losses or bundle music with other services. Content costs are always a swing factor, and any slowdown in consumer spending could hurt subscriber growth. But this is no longer a “burn cash, hope for scale” story – it’s a platform maturing into a profitable, cash-generative business with clear levers for further upside.

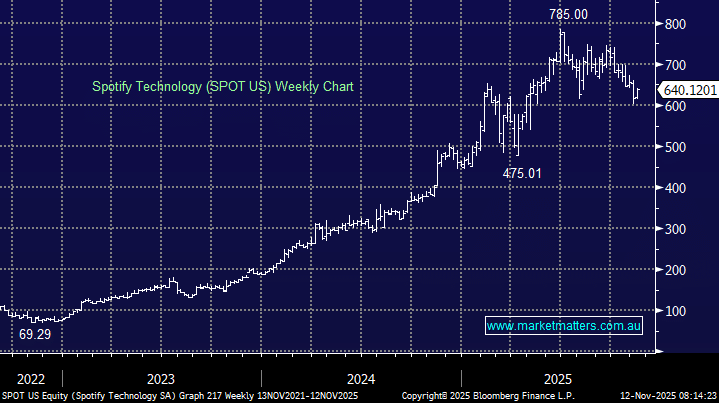

The share price peaked in July ~$US780/sh, and has since pulled back ~20%. We like the risk-reward here. Spotify is trading at a reasonable multiple for a business with genuine global optionality and improving unit economics. It’s still early in its margin expansion phase, which will drive a meaningful uplift in profitability over the next few years.

SPOT is now at a very interesting juncture. As suggested earlier, while it’s hard to pinpoint valuation, buying a high-quality business with phenomenal global reach that has executed exceptionally well is a good starting point. 45 analysts cover the stock, with 33 buys and an average price target of $US751, implying 21% upside from here.

* We are adding SPOT to our Hitlist. Our preferred approach is likely to build a position over time as we get more evidence of growth in Ad-supported revenue.