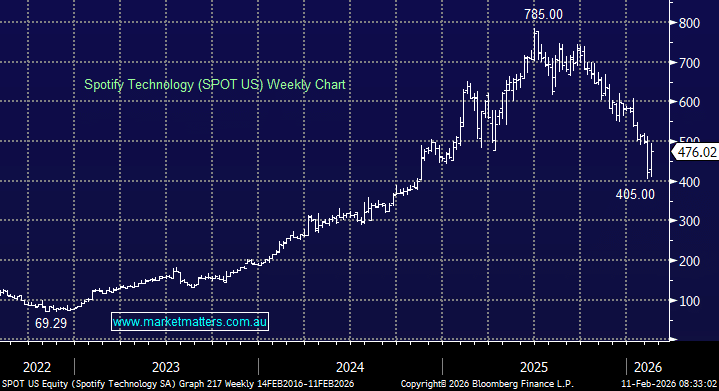

SPOT US shares ripped higher overnight (up as much as ~18% at the peak), its biggest intraday move since 2019, after a strong 4Q result and an upbeat 1Q outlook that directly addresses one of the market’s biggest concerns: margin sustainability. We own the stock, and this was a very good update.

4Q highlights:

- Operating income €701m, +47% y/y (well ahead of expectations)

- Revenue €4.53bn, +6.8% y/y (in line)

- Gross margin 33.1% (ahead of consensus)

- Monthly active users 751m, +11% y/y

- Premium subs 290m, +10% y/y

- ARPU €4.70 (ahead of expectations)

- EPS €4.43 vs €1.76 y/y

Notably, Spotify added a record 38m monthly active users in the quarter, driven by the strength of its “Wrapped” campaign, which continues to be one of the most effective global consumer marketing engines in tech. They also guided well for the 1Q, with MAU to be 759m (think about that number for a second!!), and importantly, gross margin better than expected at 32.8%. This margin guide is really important. Nearly every broker than covers SPOT was more downbeat. This should go a long wat to soothe concerns around rising wholesale label rates, with pricing power and operating leverage now clearly visible in the model.

- This result should turn the dial on SPOT. The company is proving it can grow users at scale, lift prices, and expand margins at the same time, a combination the market has historically doubted. With improving confidence around label economics and a clearer earnings trajectory, we see this update as an important de-risking event for the stock.