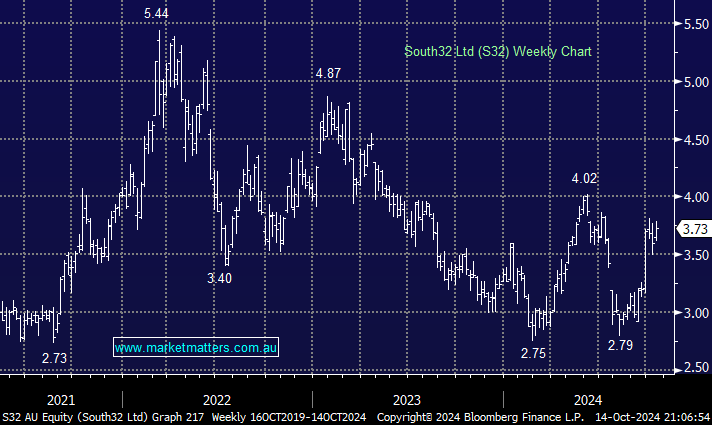

Diversified miner S32 has bounced over +36% from its August low, with most of the move unfolding after China’s stimulus last month – it caught the eye on Monday, surging +3.6%. It’s been a tough few years for S32, with its earnings mix suffering due to weakness in alumina and aluminium: In FY24, 90% of revenue came from base metals, 63% aluminium, 9% copper, 9% zinc, 8% nickel and 11% manganese. It’s not our preferred commodity mix, and while it’s a solid business, we would not be chasing it above $4.

- We may reduce our holding around the $4 area – MM is long S32 in our Active Growth Portfolio.