We hold a position in the International Equities Portfolio in an advertising technology company called The Trade Desk (TTD US). It’s been a fantastic holding since we first bought it in 2020. TTD changed how companies purchased advertising by providing deep levels of data and smarts over that data so companies could make evidence-based decisions and track their outcomes. Sticking an ad in the paper and a finger in the air to assess its impact is no longer enough!

SiteMinder (SDR) is doing a similar thing in hotels, providing the data and the smarts for hoteliers to make more informed, data-driven decisions on managing and pricing accommodation in real time. It also goes a step further with its recently launched Dynamic Revenue Plus (DR+) capability, which makes personalised recommendations on how a specific property should price its accommodation on a daily basis to maximise revenue. For example, it will take data on an upcoming event, likely impacts based on past trends and make recommendations on how a property can maximise the revenue associated with it. Gone are the days when a hotel will have a static rate; they can now utilise data analytics, automated pricing strategies, and real-time industry insights to effectively respond to changing market conditions, optimise room rates, and increase profitability.

- The property pays a subscription to SiteMinder based on the number of properties and the number of rooms. SDR have ~45k properties on their books globally, with SDR generating revenue in FY24 of ~$190m. While the business is not yet profitable, they will be underlying Ebitda profitable, and underlying free cash flow positive in FY25.

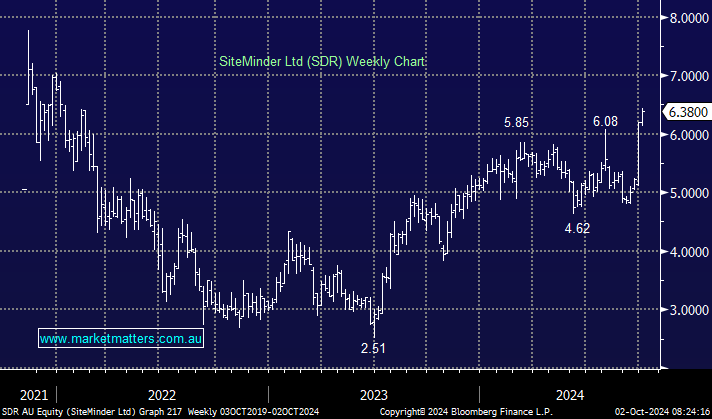

SDR resides on the Hitlist of the Emerging Companies Portfolio and the stock has surged in the past month, putting it in No 2 spot for ASX 200 winners in September, just pipped at the post by Mineral Resources (MIN). Citi has recently upgraded the stock to buy with a price target of $7.20, having conducted various channel checks around the uptake of DR+ and how future developments will drive revenue. Interestingly, SDR recently updated their long-term incentive (LTI) structure for staff to include the rule of 40, which we’ve written about when discussing our position in XRO. The rule of 40 states that a SaaS company’s revenue growth rate is added to its profit margin and the combined value should exceed 40%. In other words, growing sustainably to create long-term value for shareholders.

- We like SDR, and should have bought it post results in August, but we now await some consolidation of its recent rally.