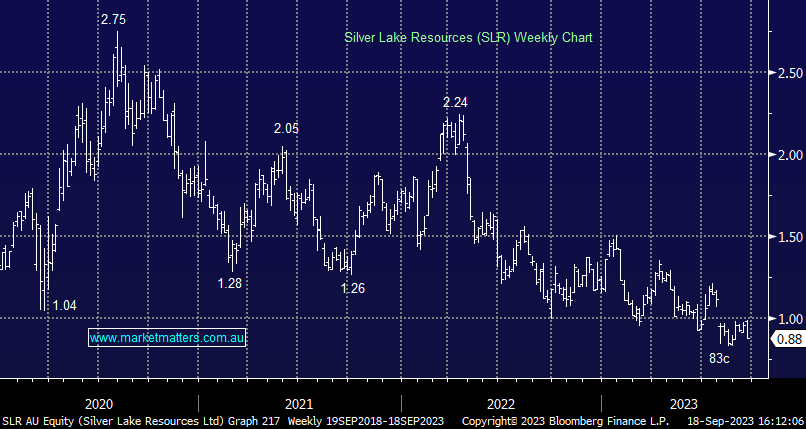

SLR -8.33%: the gold miner gave up early gains after disclosing it was the buyer of an $84m position in Red 5 (RED) this morning. The 11% stake traded at 26c, an 18% premium to Friday’s close. Silver Lake said the purchase was strategic, getting them a seat at the table of the junior gold miner and leaving the door open for a potential takeover. Red 5 owns the King of the Hills and Darlot mines near Leonora in WA with a total Mineral Resource estimate of 6.2Moz as of June 30. There have been a number of assets changing hands in the area over the last year, the most recent being Genesis (GMD) buying St Barbara’s (SBM) Gwalia mine last year. Silver Lake unsuccessfully tried to squeeze their way into that deal, now turning their attention elsewhere, putting some of the $333m cash and bullion available as at 30 June to work. A deal would make sense here given the company already has significant exposure in the region with the processing capacity at King of the Hills likely the key interest for Silver Lake.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains long and bullish SLR

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.