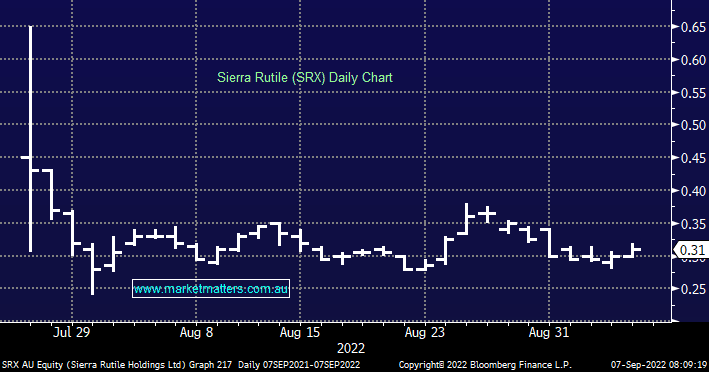

The company was born from Iluka (ILU), listing as its own entity 6 weeks ago. It has interests in 2 projects in Sierra Leone in Africa with around $60m in cash available. The company has around 25% of global rutile supply (a product used in paints, paper products and even sunscreen) making it a globally significant player. It’s cheap, with a market cap of just $127m with the market undervaluing it given the risks around mining in Africa plus the usual selling pressure associated with a small spin-out from a larger company. Its mining Area 1 produces around 100kt of heavy metal concentrate a quarter, including high-grade ilmenite, with recent margins as high as $US600/t for the rutile portion of production (35kt in the first quarter). Sierra is also looking to extend operations with the Sembehun expansion progressing, with 13 years of mine life in itself on the initial project. Overall, it’s well-funded and producing into a high-price environment however the risks remain significant given its geographical location. While we see value for the brave, we prefer local Mineral Sands company Strandline (STA) which expects to be shipping first product early next quarter.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM prefers STA to SRX at this point

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.