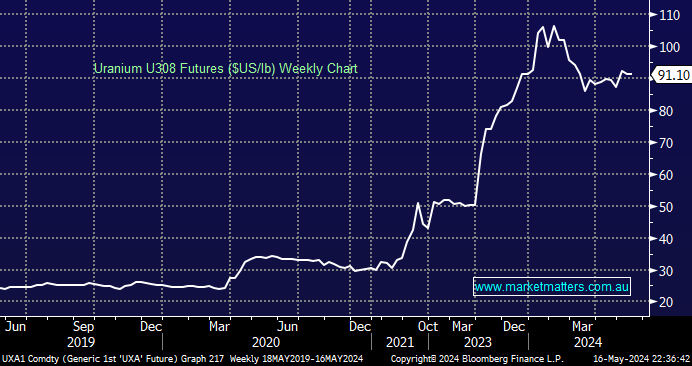

Recent years have witnessed some huge moves in cyclical commodities such as coal, lithium, and copper. Uranium is another one that can be added to the list, although it’s a touch less tangible in Australia. We obviously cannot touch the stuff, and there is no nuclear power on our shores. US President Joe Biden has just signed the bill to ban the import of Russian-sourced enriched uranium into the US. We remain very bullish on the outlook for uranium in the next few years, seeing no hurdles to the upside, although Donald Trump may reverse this particular bill if he wins in November’s US election. We could easily see uranium another 50% higher in the coming years.

Our Active Growth Portfolio has already enjoyed gains of +20% and +58% from positions in PDN this year but as the sector continues to push higher, we must question if we’ve been too cute and should simply “buy & hold” Uranium. Our Emerging Companies Portfolio remains long PDN and SLX which are performing strongly. However, we are conscious that the sector is volatile and has rallied ahead of the underlying uranium price.

NB The US, in typical self-conscious fashion, have issued waivers to allow the import of low-enriched uranium (LEU) if no alternative source is available.

- We are bullish on the volatile uranium space, but the sector has already run very hard; hence, we are likely to continue to adopt an active approach in the coming years, just as we have done recently.

This morning, we’ve updated our stance on four ASX listed uranium stocks, noting we have also been previously owned Cameco (CCJ US) in our International Equities Portfolio.