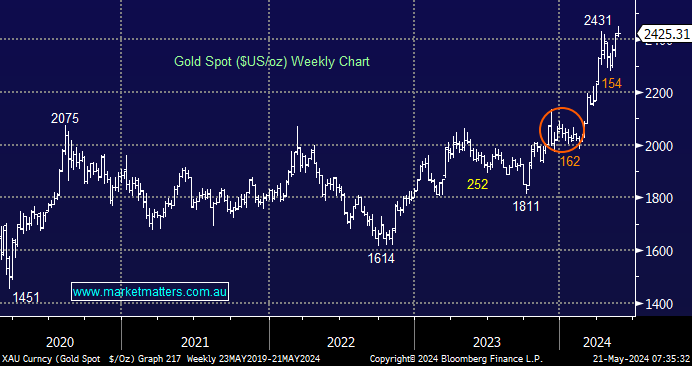

Gold made new all-time highs this week as precious metals continued their advance even when fund managers, according to the recent Bank of America Fund Managers Survey, believe they are the most overvalued since 2020. The recent move was aided by a pullback in bond yields on renewed optimism towards rate cuts and the subsequent weakness in the $US. We are a little torn towards what comes next for gold and its related stocks, although if we were traders, it would be “long or square”, most definitely not short.

- We have been targeting the $US2500 area for gold before some consolidation is likely; this looks on track so far.

- However, we remain bearish bond yields in the medium term; hence, ultimately, we’re targeting higher prices for gold and silver.

Hence, we are considering tweaking our gold exposure lower into further strength, looking to re-enter if we see another ~10% pullback, similar to the one witnessed in 2023. Importantly, at this stage, we wouldn’t be chasing the current breakout in gold, and if anything, we may “fade” the move slightly into strength, but in a similar fashion to copper, we don’t want to lose our position entirely.

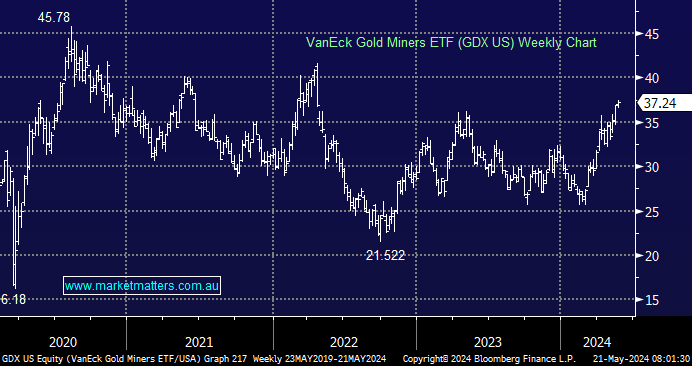

Gold has made new all-time highs this week, and gold stocks have followed suit, albeit in a disappointing fashion compared to the underlying precious metal. The sector does look cheap, with gold above $US2400, but with many companies in the group frustrating investors at almost every turn, it’s no lay-down misère. We want to play the gold advance, but it is unlikely to be a straight-line move for all of the ASX names.

- We can see the GDX ETF testing $US40 in the coming weeks, or another ~10% higher.