Trade ideas are provided as a guide only. Market Matters is not investing in these ideas as we do our other suite of portfolios available here. If trades are updated through the week, these updates will be advised in the morning note and will be flagged as an alert on the home page of the website. Separate emails or SMS messages will not be sent for Shawns Trade Ideas. The ideas are General in nature only.

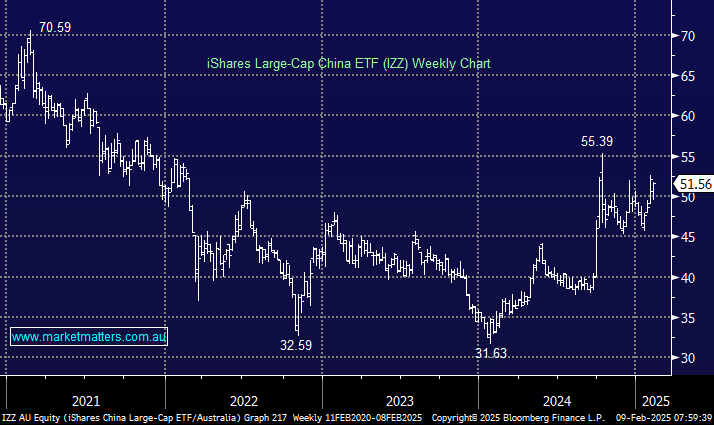

We are bullish on Chinese equities, especially from a relative valuation perspective. After consolidating their stellar gains when the significant stimulus was unleashed on the Chinese economy and equity market in September, we believe they have commenced another leg higher. The ASX-listed iShares Large-Cap China ETF (IZZ) currently holds prominent, well-known names such as Alibaba 9.8%, Tencent 8.7%, JD.com 4.6%, BYD 4.4% and Bank of China 4.1% making it an excellent proxy for an advance by Chinese stocks, we are initially looking for 15-20% upside affording some attractive risk/reward at current levels.

NB This will likely be filled on the opening this morning following weakness by US bourses on Friday night.