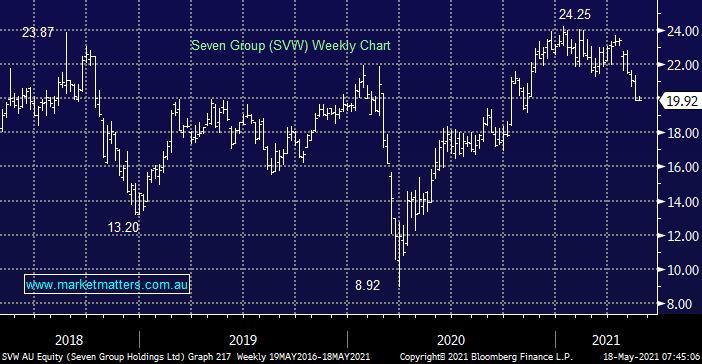

SVW has fallen -6% over the last week taking it down 18% below its 2021 high although it has clearly enjoyed a great recovery from its COVID low under $9. This highly diversified business operates in everything from TV to Telco and mining equipment making it hard to value at times. The company raised money back in April at $22.50 which looks opportune today with the stock ~10% lower and over recent weeks we might be seeing some disgruntled buyers taking a small loss on the chin. As we said there’s a lot of moving parts in this business and at today’s prices it doesn’t scan as overly cheap.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral SVW

Add To Hit List

Related Q&A

Seven Group after Boral acquisition

MM’s view on Seven Group (SVW) please

Does Seven Group’s debt level underwhelm the investment case?

Bega (BGA) & Seven Group (SVW) – when to buy?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.