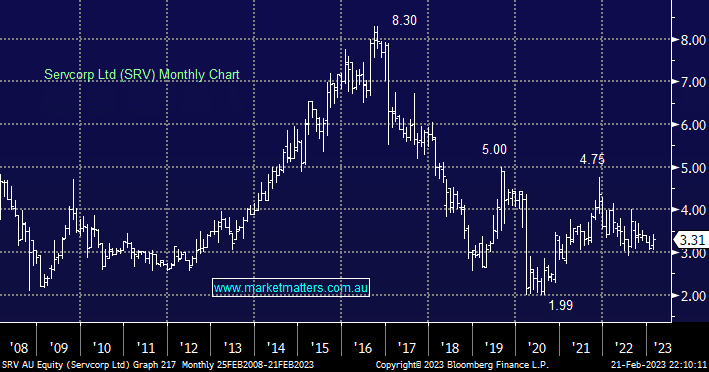

The coworking office company released their HY numbers last Thursday with the stock up ~4.5% since the print. The numbers were solid, Net Profit Before Tax (NPBT) up 49% to $20.3m with North America, Europe and the Middle East the key drivers to the rebound while Hong Kong continues to underperform highlighting the important diversification within the business. The company also maintained guidance, putting the stock on a cash adjusted PE of just ~7x, couple this with a great balance sheet with $115m in cash, a growth target of floor growth of 10% in the next 18 months and floor occupancy that continues to rise (74% in the half), Servcorp looks incredibly cheap. We think the stock has been unfairly bundled up with US-listed We Work (WE US) which has $US20b in debt and remains loss-making.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is bullish SRV

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.