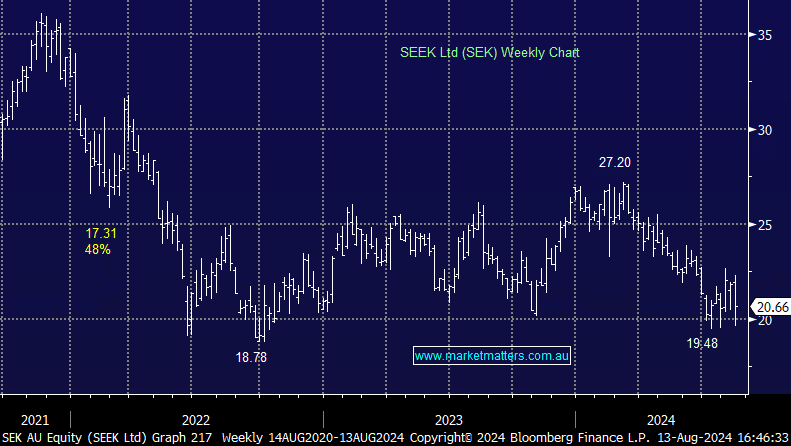

SEK -6.64%: Lower than expected earnings for FY24 and a decent downgrade to FY25 guidance – the stock was righty sold off, and probably a little underdone on the selling, though we were not on the call today to hear what was said.

- FY24 Revenue of $1,160m (vs consensus of $1,165m), EBITDA of $483.1m (vs consensus of $496.6m) and underlying NPAT of $179.0m (vs consensus of $190.1m)

- FY25 guidance for EBITDA of $430-500m compares to consensus of $527m, an 11% miss at the mid-point.

- The lower guidance is largely driven by a much lower volume assumption, with the company assuming a low teens decline in Seek ANZ job ad volumes in FY25, which seems very conservative

In any case, weaker than expected FY25 guidance will see the stock in the sin-bin until there are signs that guidance is indeed, too conservative.