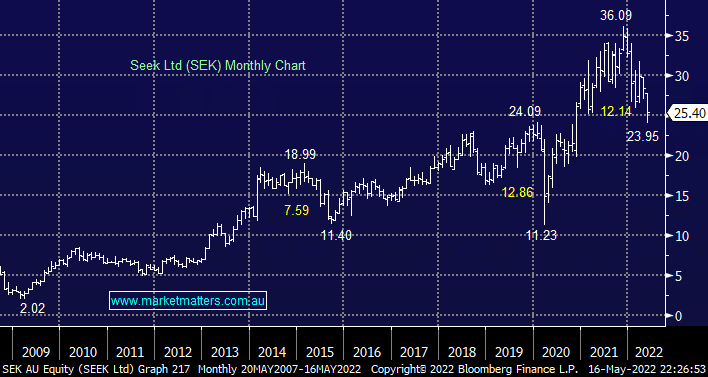

At MM we’re often asked what’s our favourite beaten up tech name (s) and the answer is by definition dependent on the market/prices on the day however one that looks attractive today after its 34% correction is on-line employment business SEK which importantly has a strong degree of certainty around its earnings as opposed to the “smoke and mirrors” that carried much of tech stocks higher post the GFC and COVID. The stocks currently trading on an Est P/E for 2022 of 36x while also paying an estimated small 1.7% yield, nothing too scary in our opinion i.e. we feel it’s likely to have less downside than many other tech names from here if the sectors valuation contraction continues.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

MM likes SEK around $25

Add To Hit List

Related Q&A

Why sell and buy SEEK within a month?

What are MM’s thoughts on SEEK near $25?

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

What’s MM’s favourite 5 stocks for short term bull run?

MM’s view on SEK & ANN

MM view on Seek (SEK)

Question on SEK

CUV and Seek (SEK)?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.