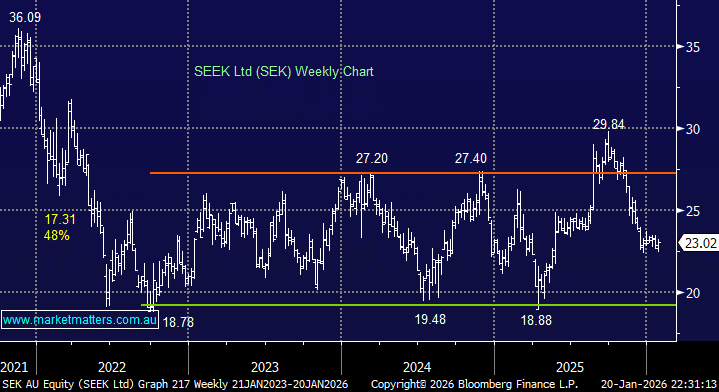

Seek is the online employment marketplace connecting employers and jobseekers across Australia and international markets through its digital recruitment platforms which most of us having at least looked at it at one stage. SEK has corrected 23% from its September high, with the stock now trading around 18% below its average 5-year valuation. SEK is growing its revenue steadily as it expands overseas, with it forecast to lift FY25 numbers by +18% into FY27. We also like its overseas earnings diversification, with ~30% of FY25 coming from the likes of South East Asia and Hong Kong.

Soft Australian job adds have weighed on SEK over recent years, and things aren’t improving yet: according to the ANZ-Indeed Australian Job Ads series, job advertisements fell about 0.5% in December 2025. Early 2026 is also pointing to an ongoing cooling labour market, with advertised roles and vacancies easing and workers becoming more cautious about changing jobs. While conditions remain tight by historical standards, hiring momentum has clearly softened from prior years. SEK is a quality company, but the economy is likely to determine the next 10% move.

Long-term, it’s hard to clarify AI’s impact on job ads, as many people will be forced to re-skill as AI replaces many roles. Another uncertain variable, which, along with the economy and overall negative sentiment towards growth, is weighing on SEK’s share price and valuation. If the market continues to believe the RBA will hike rates, SEK may struggle to enjoy any meaningful upside through 2026 – not our preferred scenario.

- We believe SEK is a quality company that will provide an excellent opportunity in 2026, but it needs to clear a couple of real sentiment hurdles.