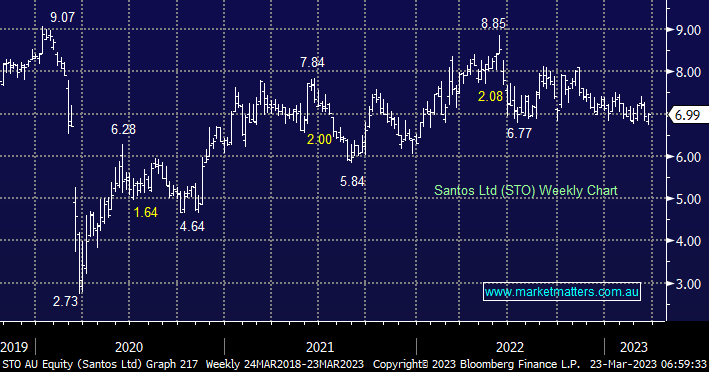

Oil and gas producer STO has struggled to match high-flying Woodside over the last 6-12 months, a number of stock specific headwinds operationally were at play following their acquisition of Oil Search while their larger rival executed a great deal buying BHP’s Petroleum business, a deal which clearly captured more attention from overseas investors with deep pockets. WDS remains our preferred vehicle of choice for exposure to the oil and gas sector.

- We have been targeting the $6 area for STO over the last year and we see no reason to change this outlook.