The last month has seen the ASX200 rally less 3% but the tech stocks have soared, happily including our positions, conversely as discussed earlier the resources have fallen away after a stellar 2021 to-date e.g. OZ Minerals (OZL) -14%, BHP Group (BHP) -4% and Alumina (AWC) -8%. When we consider the performance of our holdings in the tech related space it paints a very clear picture over the period:

Winners : Altium (ALU) +35%, Bravura (BVS) +14%, Carsales.com (CAR) +11%, HUB24 (HUB) +21%, Megaport (MP1) +28%, Xero (XRO) +11% and Zip Co Ltd (Z1P) +17%.

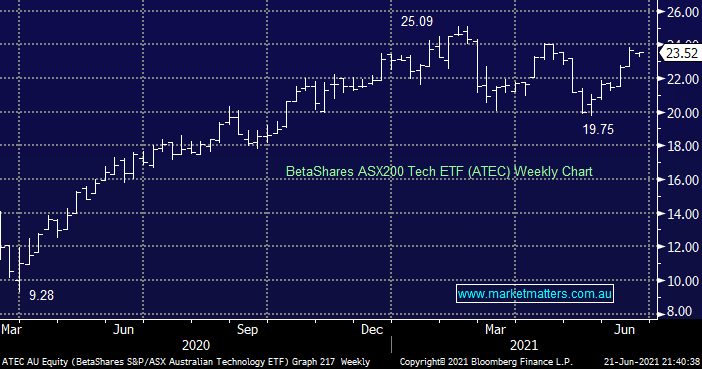

A couple of the above stocks don’t actually reside in the Australian Software and Services (Tech) Sector per se but they are highly correlated which is the most important factor to us. From a portfolio perspective its important not to become married to ideas and while our overweight view around IT is clearly paying dividends at this point in time a 27% portfolio weighting when compared to an ASX200 index weighting closer to 5% is significant i.e. we are currently very overweight!

Hence we are looking to pick an opportune time to start migrating our portfolio back from tech towards the value end of time, or simply into higher cash reserves short-term. By definition the logical place to start is deciding which, if any, of our 7 holdings have satisfied our objectives and look prime candidates to be sold into current strength – note we still see further upside from the sector in general but must be cognisant of our portfolios exposure. Today I have taken a very brief look at our positions before summarising our likely short-term sells.