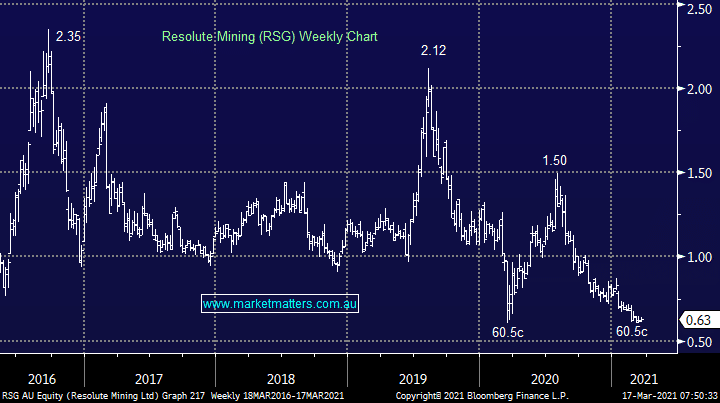

We have increased gold exposure in the Flagship Growth Portfolio but have yet to add to the Emerging Companies. There are a number of small/mid cap gold miners on the ASX but plenty of them aren’t yet producing – not so much a requirement to be in the portfolio, but it certainly helps. Resolute Mining (RSG) is a producing miner with 395koz throughput in 2020 with an cost (AISC) of $1,074/oz – a pretty handy margin to the current spot price. Shares have more than halved since the middle of last year, with a lot to do with a) their balance sheet, & b) a tax issue. We see value around here with the stock trading at nearly 4 year lows. The year ahead will see deleveraging of the balance sheet, lower costs as operating conditions improve & a clever hedging book reducing risk. The tax issue continues to be disputed however any outcome here will likely see a relief rally given the company is well provisioned for an adverse outcome.

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM are buying RSG in the Emerging companies Portfolio, with a 4% weighting around 63c

Add To Hit List

Related Q&A

Thoughts on Resolute Mining (RSG)

Update on RSG from Harry

Question on Resolute Mining (RSG)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.