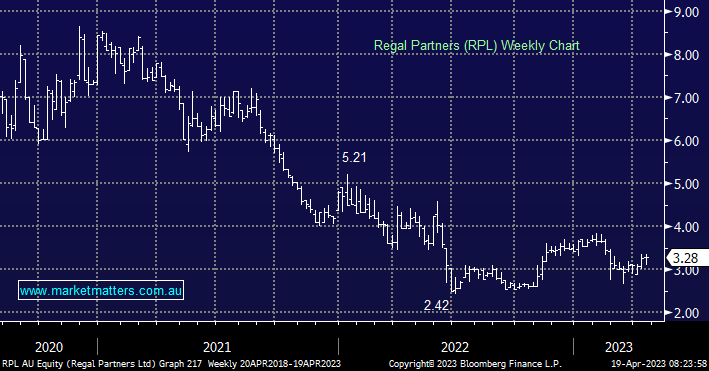

The fund manager was out with a quarterly update on Monday night showing net inflows of $200m, with an additional ~$100m earnt through performance. This takes the group Funds Under Management (FUM) to $5.5b and only requires an additional $100m in net flows in the fourth quarter to hit the $1b mark for the year. While the numbers were in line with expectations, we were slightly disappointed with the flows given $200m was earmarked earlier in the year for their new Private Credit fund. Despite this, Regal is one of only a handful of Fund Managers experiencing inflows to their products and they will be adding a new alternative Ag fund to their portfolio suite next month to further support flows. They have ~$210m in cash on the balance sheet and are incrementally putting it to work including the acquisition of Asian long/short manager East Point. We continue to see Regal as the premier listed alternative asset manager with the ability to grow FUM both organically and inorganically with its balance sheet.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM is long RPL in the Emerging Companies Portfolio, and bullish above $3

Add To Hit List

In these Portfolios

Related Q&A

Regal Partners (RPL) performance

Regal Partners (RPL) and Smart Group (SIQ)

Dividend Trap?

Fund Managers

Does MM now like Regal Partners (RPL)

Is Regal Partners Limited (RPL) worth a punt?

Queries on FSLR, FTCH (US) and CLX, RPL (ASX)

Can MM please clarify your thoughts on Regal Partners (RPL)?

Thoughts on RPL & MAAT please

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.