Alternative asset manager RPL delivered a strong 1H24 result earlier in the year, which saw FUM hit $11bn. This, combined with a strong balance sheet and solid performance, is an exciting backdrop for RPL. Not many analysts cover this $869 manager, but we liked the numbers: revenue was up 17% to $112m, delivering an underlying profit after tax of $32.7m. While it’s not cheap for the amount of FUM they manage, the alternative asset management space is growing, and we think Phil King is a savvy operator.

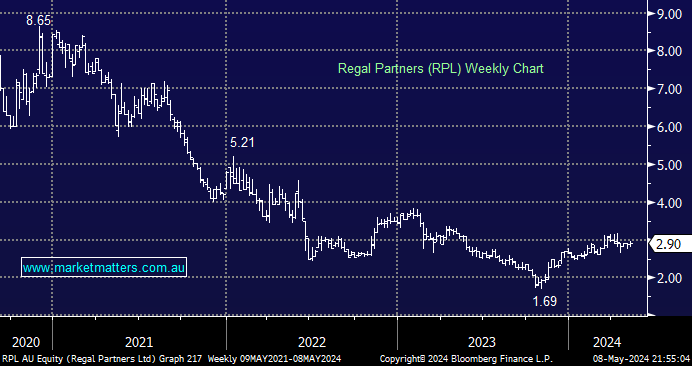

- We like RPL below $3, initially looking for around 20% upside – MM is long RPL in our Emerging Companies Portfolio.