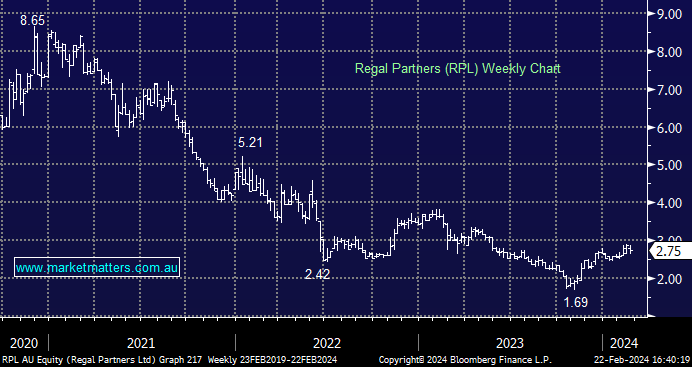

RPL -0.72%: strong 1H24 result from the alternative asset manager, with FUM hitting $11bn, a strong balance sheet with $240m net cash, and performance holding up which is important for future FUM flows. Not a lot of analyst coverage on RPL, however, revenue up 17% to $112m delivered an underlying profit after tax of $32.7m, up ~32% on pcp – both solid.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remain long & bullish RPL in the Emerging Companies Portfolio

Add To Hit List

In these Portfolios

Related Q&A

Are Regal Partners (RPL) and IDP Education (IEL) a reasonable entry point ?

Regal Partners (RPL) and IDP Education (IEL) – oversold companies?

Regal Partners (RPL) performance

Regal Partners (RPL) and Smart Group (SIQ)

Dividend Trap?

Fund Managers

Does MM now like Regal Partners (RPL)

Is Regal Partners Limited (RPL) worth a punt?

Queries on FSLR, FTCH (US) and CLX, RPL (ASX)

Can MM please clarify your thoughts on Regal Partners (RPL)?

Thoughts on RPL & MAAT please

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.