RPL +5.49%: The fund manager announced strong 1H23 numbers today with Net Profit up 98.5% to $13.1m, covering more than half of the FY23 consensus numbers in the process. Costs fell 10.7% as they realised synergies following the VGI Partners merger completed last year. Flows have been strong, FUM was up 23% in the last 12 months largely thanks to strong performance numbers in new and alternative investment options. They had $234m cash in hand at the end of the period, making up about a quarter of the value of the business and supporting plans for more M&A.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 11th July – Dow up +192pts, SPI up +27pts

Friday 11th July – Dow up +192pts, SPI up +27pts

Close

Close

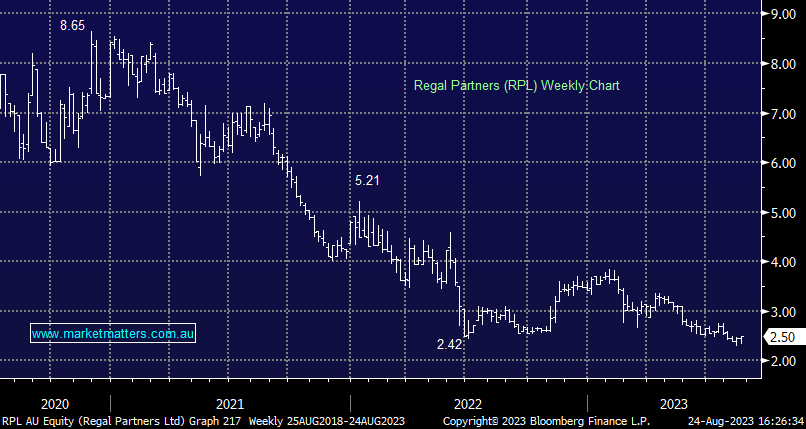

MM is bullish RPL ~$2.50

Add To Hit List

In these Portfolios

Related Q&A

Regal Partners (RPL) and IDP Education (IEL) – oversold companies?

Regal Partners (RPL) performance

Regal Partners (RPL) and Smart Group (SIQ)

Dividend Trap?

Fund Managers

Does MM now like Regal Partners (RPL)

Is Regal Partners Limited (RPL) worth a punt?

Queries on FSLR, FTCH (US) and CLX, RPL (ASX)

Can MM please clarify your thoughts on Regal Partners (RPL)?

Thoughts on RPL & MAAT please

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 11th July – Dow up +192pts, SPI up +27pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.