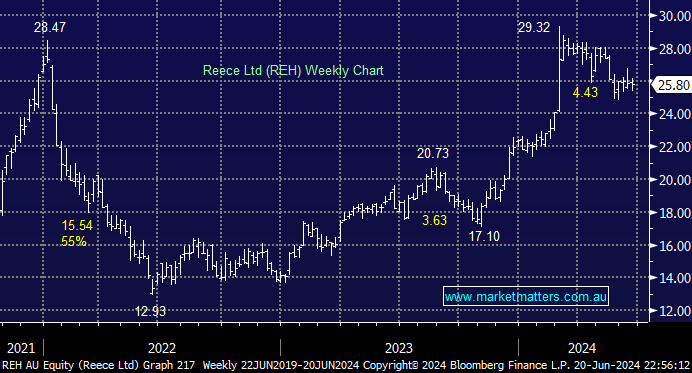

Plumbing and hardware business REH surged higher in February following its strong HY24 result, which demonstrated solid profit growth and subsequent broker upgrades. Strong earnings were driven by cost control and operational efficiencies despite a relatively subdued demand environment, i.e. impressive prudent management. The US is the growth story for REH, with the company aspiring to lift its ~20% exposure above 50% moving forward. The risk/reward is appealing under $26, with the company having demonstrated its ability to shrug off tough trading conditions.

- Through 2024, sticking with the strength has paid dividends, and REH currently carries this mantle above its peers at the moment.

- We are initially targeting a test of $30, or 15% higher, but it could extend further when the Fed & RBA start cutting rates.

We discussed Reliance Worldwide (RWC) with a similar conclusion of “cautiously bullish”.