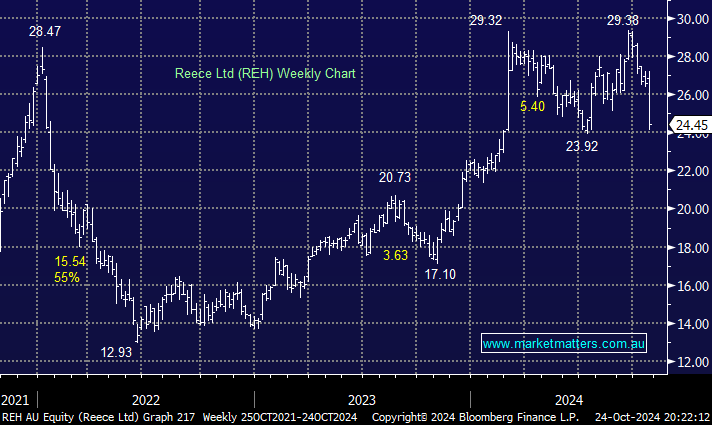

REH tumbled almost 8% on Thursday making it the worst performer on the main board, the plumbing and hardware merchant experienced its worst day since August 2021. The company said 1Q sales revenue declined 4% to $2.23bn, down 4% on a constant currency basis. A couple of standout comments probably accelerated the selling as management discussed challenging conditions in the housing market remaining:

- “As we look ahead, the lead indicators continue to be challenging in both regions. While the US has seen its first rate cut, this will take time to work through the system.”

- “Challenging trading environment has continued during the first quarter driven by ongoing softness in housing activity in both regions”.

This is another example of an ASX company trading on an elevated valuation not living up to expectations, at least in the short term, with the obvious consequences. However even after the recent weakness the stocks trading on the expensive side compared to the last few years.

- We see obvious support around $24 but prefer other stocks, such as James Hardie (JHX) to gain exposure to an improving construction environment.