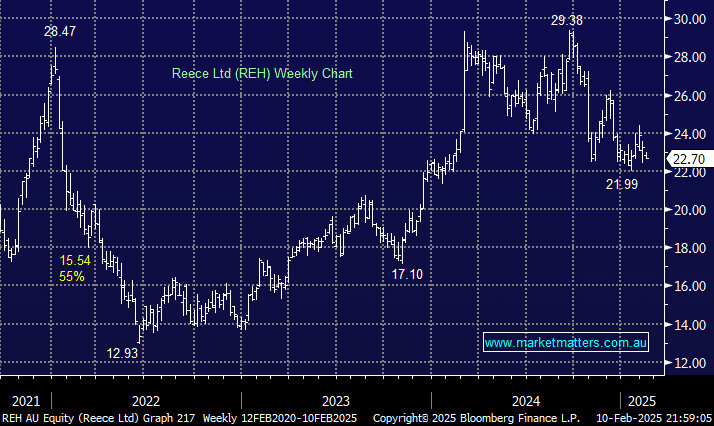

REH fell -2.3% on Monday, slipping down towards its 12-month low, in this case not a high-flyer experiencing profit-taking. The plumbing and hardware merchant has struggled over the last six months due to soft housing activity in the US and at home, not ideal when your stock was being priced for growth. That said, if the RBA cut this month, it should help, and while the Fed is likely to be on pause for a while, Treasury Secretary Bessent has been highlighting the administrations target towards bond yields – they want them lower, and bond yields are what feeds into the pricing of mortgages.

REH now generates ~60% of its revenue in the US, so it’s an important market, while valuation is now coming back to more palatable levels, having been stretched nearer $30. This is a stock we’ll revisit in 2025 when they show further signs of operational improvement.

- We will await the REH result in 2 weeks and update our views then accordingly.