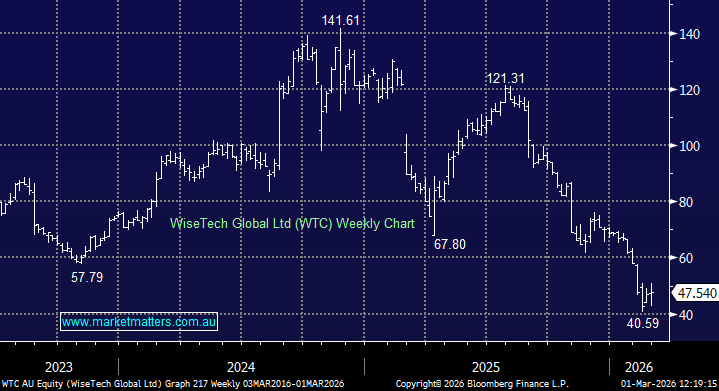

Plumbing and hardware business REH has endured an awful 12-months, not helped by the weak US housing market where it generates almost 60% of its revenue. REH disappointed with its earnings in June with volumes remaining subdued due to the soft housing market while competition has been intensifying across all segments of its US business. This of course was compounded by it’s high valuation for the type of business it is – i.e who would buy a plumbing supply business on 40x earnings, which is where it was in 2025!

While it’s not cheap now, the 15 PE point re-rate it has experienced, down to 25x makes is more palatable. We feel REH is now offering an aggressive opportunity to take advantage of a turnaround in the local and US construction industry.

- An aggressive call, but the risk/reward for REH is looking interesting below $14 following its negative re-rating, especially from a risk/reward perspective.