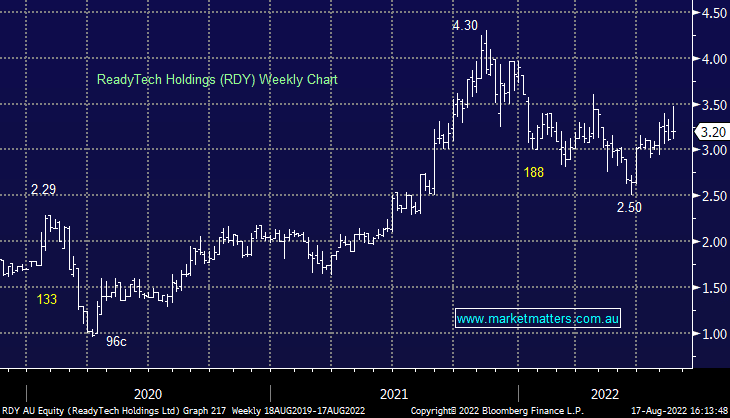

RDY -0.62%: FY22 results this morning and we had the CEO & CFO in for lunch today. Revenue and underlying EBITDA was ~4% ahead of company guidance while they talked to strong momentum coming out of FY22 into FY23. The key highlight was the FY23 revenue guide that implies mid-teens growth again (off a growing base) and an increase in their FY26 revenue target to over $160m. While we don’t own RDY (yet) this is at the top of our Market Matters Hitlist for our Emerging Companies Portfolio.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM is bullish RDY ~$3.20

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on ReadyTech Holdings (RDY) and IPH Ltd (IPH)

buying stocks in emerging portfolio

Which Emerging Company does MM prefer SLX, RDY or SRG?

Question on IPO’s

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.