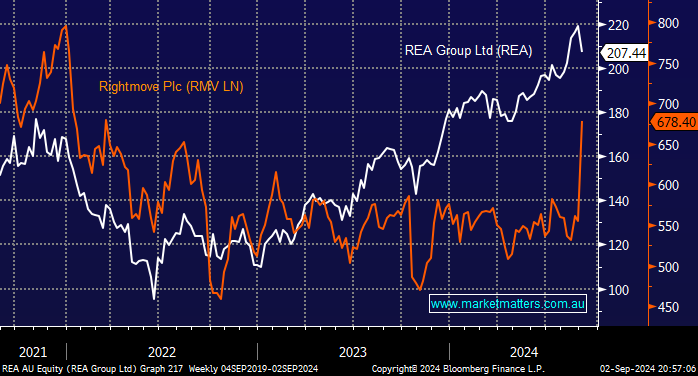

At Friday’s close, it had been a very different story for these two property-classified businesses through 2024:

- REA Group (REA) had surged over 20%, taking its market cap to ~$A29bn.

- Rightmove Plc (RMV LN) had slipped -3.5%, taking its market cap to ~$A8.5bn.

REA told investors on Monday that it was considering a possible cash and share offer for RMV – certainly good timing from a relative performance perspective.

- Similar to REA, RMV is the UK market leader, although its stock performance hasn’t been close to REA’s.

- RMV does revenue of ~$700mn whereas REA did $1.5bn in FY24.

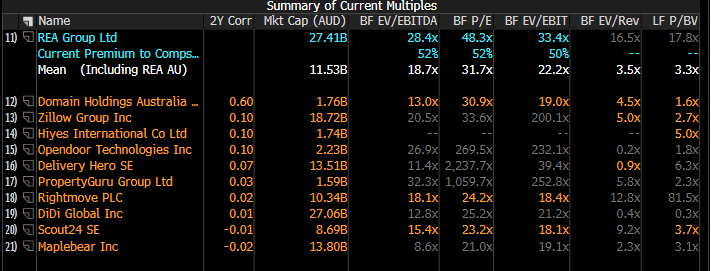

Following the news, REA’s share slid over 5%, and RMV’s surged over 25%. From a relative valuation perspective, with REA trading at a significantly higher earnings multiple to RMV, it makes total sense to use higher-valued scrip to buy lower-valued scrip, though that will of course be dependent on the premium they need to pay to get the deal done.

Markets hate uncertainty, and large takeovers into foreign lands bring risks, with many examples of woe littering the ASX. However, with RMV relatively cheap and REA looking to part-fund the deal with shares, this potential deal looks interesting, and we can understand why they are pursuing it. Because it increases risk, we suspect that REA’s share price could trace back towards the $180-190 region where it spent much of 2024.

- We like the flagged move by REA but aren’t keen to chase the stock without more details.