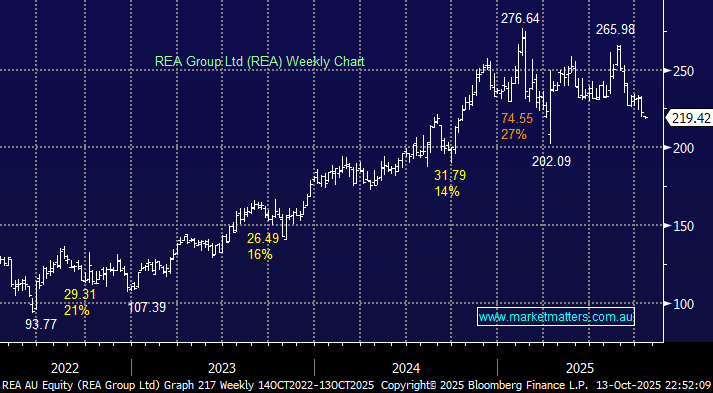

REA has experienced some valuation contraction of late with the stock trading on 25x, around ~8% cheap relative to its own history, despite a solid FY25 result in August which saw improved margins and upbeat commentary. We wrote about the stock post the result, saying we were neutral and had no intention of chasing the real estate behemoth above $250. However, the stock is now ~15% lower, making it worth a revisit. We continue to believe that REA is a great business, but it now has a credible competitor, which is likely to change the dynamics on several fronts:

- CoStar has bought Domain (DHG), which brings the $49bn US giant into direct competition with the smaller $29bn REA, a factor local real estate agents are likely to be cheering!

It’s hard to estimate the discount on REA’s valuation to justify this new threat, but ~10% feels light in our opinion. Another 10% lower in the stock “feels” about right, especially when we consider REAs looking to diversify itself internationally. It already generates ~8% of its revenue from India, while last year it tried to acquire Rightmove, the UK’s largest property marketplace. These sorts of moves will likely persist, as they look for growth elsewhere, creating some uncertainty around REAs next chapter. Importantly, this also takes place under a new CEO, with Cameron McIntyre taking over from Owen Wilson on 3rd November (Wilson will stay on, becoming Chairman of the Indian business).

- We think there are too many variables to get interested in REA at current levels. A move back below $200 would start more appealing.