RHC -11.95%: Hit hard today after their FY23 results missed the mark – a continuance of recent woes for the private hospital operator. While top-line revenue was a shade above consensus, as was underlying EBITDA and EBIT, higher than expected interest and tax led to a large miss for Net Profit After tax (NPAT) which came in at $271m vs consensus $348m, down 9% YoY. A fully franked final FY23 dividend of $0.25 was declared which was around half that expected. Management’s FY24 group outlook commentary is for mid-single top-line growth which is inline with expectations, however, they also expect margin recovery to be slowed by ongoing inflationary pressures, which will flow through to lower earnings.

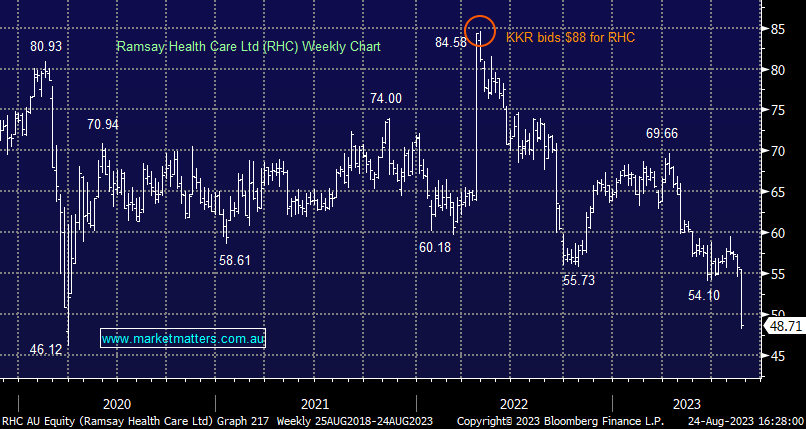

- Our optimistic view of recovery has been wrong, as higher costs hurt earnings. While clearly weak, the large decline in share price should attract further interest from potential acquirers, and for that reason, we are likely to hold.