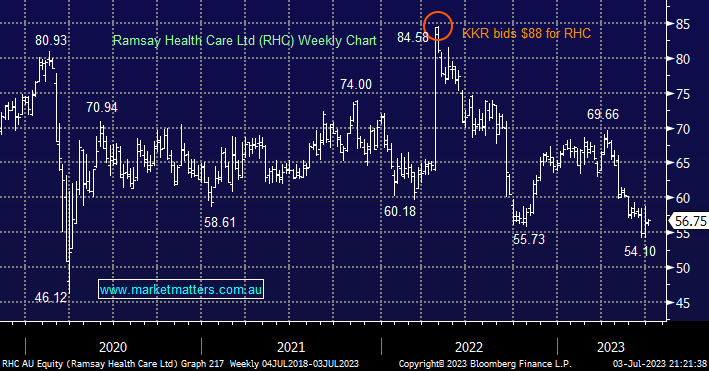

Private hospital operator RHC has finally found some support after announcing they are considering selling their joint venture in Asia, with several buyers apparently circling the operation. Just over 12 months ago KKR bid $88 for RHC but as the bid fell apart so did the stock however a streamlined operation might again garner some M&A interest although this is not the reason to purchase RHC, the earnings recovery that is underway will drive it’s valuation lower in FY24 and particularly in FY25.

- We like RHC believing it’s offering value under $60 for those with a medium-term view.