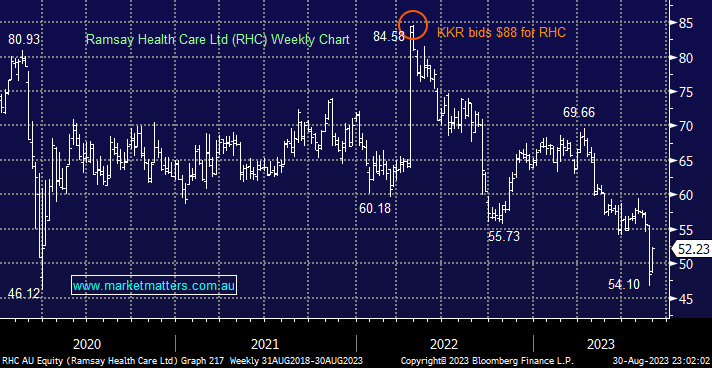

RHC was walloped after a disappointing FY23 miss, another cross next to the hospital operators name – its hard to imagine that KKR bid $88 for the stock in 2022 and management didn’t do all in the power to get the deal done. This month’s report saw Net Profit After tax (NPAT) come in at $271m vs consensus $348m, down 9% YoY which was a big miss which saw the stock plumb its COVID low, another business, not a miner this time, that’s been hurt by higher costs.

- Our post COVID recovery theme has proved wrong, but below $55 we can see further interest from potential acquirers, hence at least for now we are likely to hold – we hold RHC in our Flagship Growth Portfolio.