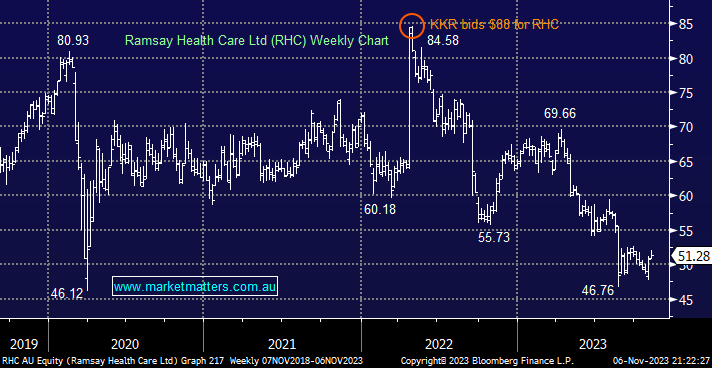

RHC has fallen -21% in 2023 after reporting poorly in August due to higher costs. Our post-COVID recovery theme has proven wrong, but around $50, we believe value has returned to the private hospital operator; hence, we’re holding for now but aren’t married to our position and have no plans to average at these depressed levels. It’s hard to imagine that KKR bid $88 for RHC last year, the board didn’t help at the time, and now the stock is more than -20% below its pre-bid price, they are well overdue some redemption and reining in costs would be a great place to start.

- We like RHC in the $50 region and are reticent to cut this loser where value looks apparent – MM owns RHC in our Active Growth Portfolio.