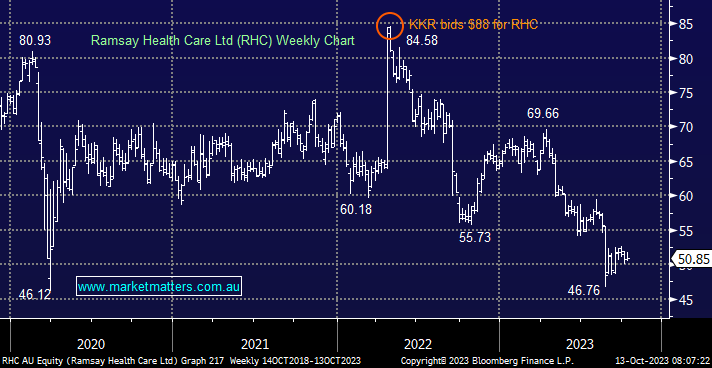

It’s hard to imagine that a -21% fall in 2023 only has RHC as the 5th worst stock in the sector, but it tells the tale of a tough period for healthcare stocks. RHC was another sector name which plunged lower after reporting badly in August – Net Profit After Tax (NPAT) came in at $271mn vs consensus of $348mn, a huge miss courtesy of higher costs. Our post-COVID recovery theme has proven wrong, but around $50, we believe value has returned to the private hospital operator; hence, we’re holding for now given the value we ascribe to their property portfolio, while we think the earnings recovery has simply been delayed.

- We like RHC in the $50 region and are reticent to cut this loser where value looks apparent – MM owns RHC in our Active Growth Portfolio.