We talked about RHC recently, but the private hospital operator is now getting airtime as new Chairman David Thodey, who takes the helm next month, has the opportunity to restructure the business and wipe his hands clean of what came before. Here are a few things to consider:

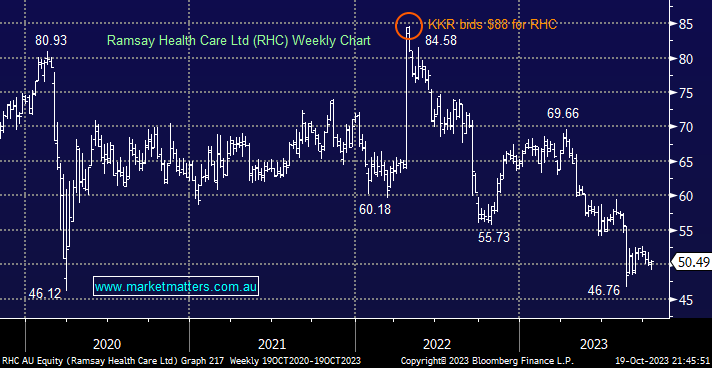

- Investors are still peeved by the missed opportunity when KKR bid $88 for the company in 2022.

- The biggest stumbling block for the deal was overseas operations, and we believe this is an excellent opportunity for the new boss to sell off some/all of these operations.

- RHC is already looking to offload its Malaysian JV business, Ramsay Sime Darby why not its problematic French business Ramsay Sante.

- The UK business might be a step too far, but we believe offloading Sante is the key to unlocking real RHC value.

We think it’s clear that the sum of the parts that make up RHC are worth far more than the combined entity, and this would allow the company to refocus on its local private hospital business. We initially liked some of the comments from Mr Thodey – “We’re making sure there’s good alignment between the issues we are looking at, and those of investors,”.

- We like RHC in the $50 region and are reticent to cut this loser where value looks apparent – MM holds RHC in its Active Growth Portfolio.