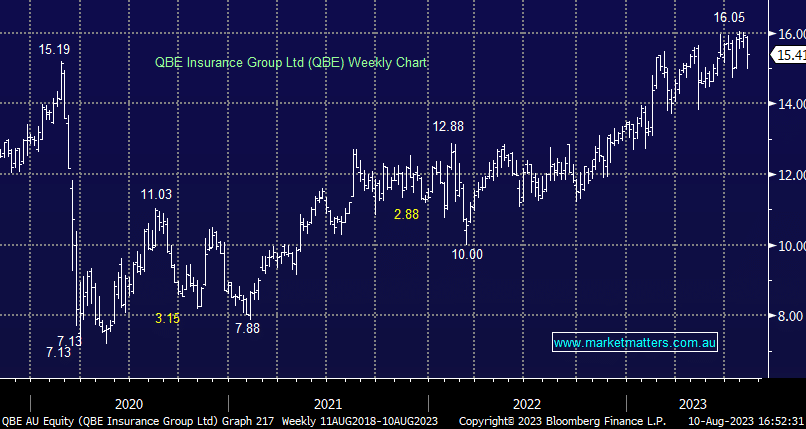

QBE -1.22%: The same old story for QBE today, a messy/underwhelming 1H23 result which pushed the stock down on open then it recovers throughout the session as they talked favourably about the future, reconfirming FY23 guidance. 1H23 NAPT of $404m compared to $500m consensus while the interim dividend was also light on, at 14c v consensus of 24c. The miss seemed to be driven by a higher tax rate however there was also a lot of complexity around a change in accounting standards, which frankly, confused us. We need more time to review the result before casting judgement.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains neutral QBE

Add To Hit List

Related Q&A

Correlation of bond prices/yields to the fortunes of QBE

Updated views on QBE given recent events

Thoughts on QBE & bank hybrids please

Is this as good as it get for QBE Insurance (QBE)?

QBE

Thoughts on QBE

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.