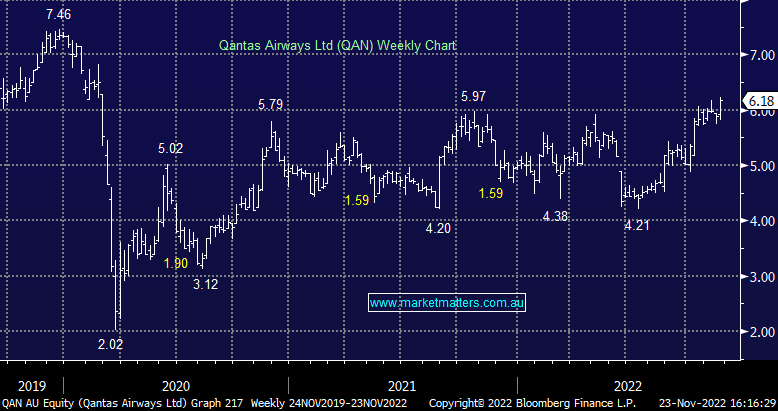

QAN +5.28%: Rallied today on another earnings upgrade just 6 weeks after their last one, the flying Kangaroo now saying profit before tax (PBT) would be $1.35-1.45bn for 1H23, a $150m increase on their last update. While only early days, the momentum is clearly strong in QAN and we suspect they’ll look to re-charge their current $400m share buy-back which is now 76% complete. The market is now a lot more rational i.e. higher prices, and the consumer is still keen to travel. On UBS numbers, QAN is now trading in a PE of 7.7x for FY23 with strong earnings ‘tailwinds’, although when you look at what is being charged for overseas travel, it’s hard to see such buoyant conditions remain if we nosedive into recession next year.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral/bullish QAN, but it is not without risk

Add To Hit List

Related Q&A

MM’s view on tourism stocks

Is Qantas turning around ?

Does MM plan to buy Qantas shares (QAN)?

Does MM like the AIZ rights issue?

MM views on Qantas (QAN) & Kogan (KGN)

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.